About:

1. What will we learn from this book?

• Rich people do not work for money, rather money works for them. • How much you earn matters more than how much you have. • Learn to work with your own business. • How Taxes Work • Rich people invest money. • Work for learning, not for money. • Learn how to remove the hurdles of life. • Start2. Who should read this book?

Of course, this book can be useful for everyone, every person who wants to become rich can learn from this book how to earn money from money. Being rich is also an art and to learn this art, the key ideas of this book will help you a lot.3. Who is the author of this book?

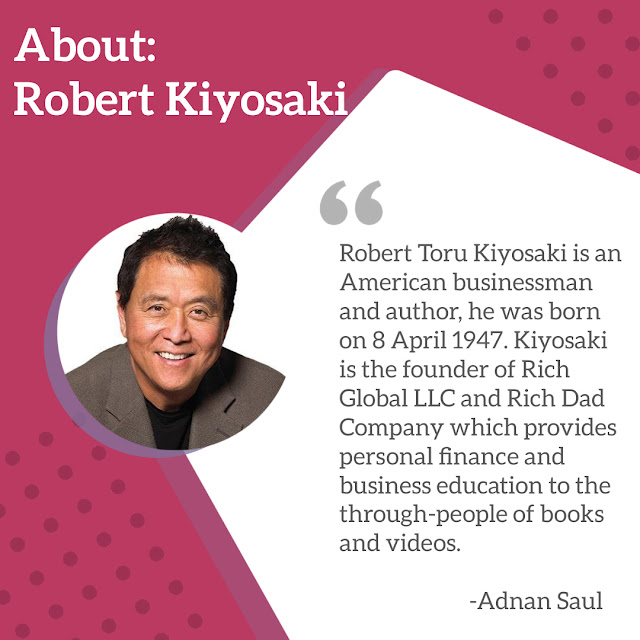

Robert Toru Kiyosaki is an American businessman and author, he was born on 8 April 1947. Kiyosaki is the founder of Rich Global LLC and Rich Dad Company which provides personal finance and business education to the through-people of books and videos. The main revenue source of the company is the franchise seminars of Rich Dad, which the independent people use the brand name of Kiyosaki and give it to the company as a fee. Kiyosaki has written more than 26 Motivational Self Help Books so far, of which Rich Dad Poor Dad is considered the most popular.Robert Kiyosaki, the author of this book, had two fathers. He had a father who was an educated, PhD holder but remained poor throughout his life and died in poverty. That's why Robert called them Poor Dad. At the same time, his other fathers were not very educated but were very rich. He was called Robert Rich Dad. Now it is a matter of thinking about how any human being can have two fathers at the same time. His poor father had only one dream that Robert, after studying hard, would secure his future by working in a big company. But Robert's other father, who was rich, was actually the father of Mike, Robert's friend. They wanted Robert to have some challenges in their lives. Because all the lessons are not learned only in school. There are some lessons that a person learns from the experience of his life. Schooling can only lead to good grades, but the study of life teaches a lot. Of course, education has its own importance but nothing can be achieved only by sitting on it.

Lesson 1: Rich people do not work for money

Once there was a man who had a donkey. Whenever he had to get some hard work done with his donkey, he used to hang a carrot in front of him. On seeing that carrot, the donkey used to work in the temptation of eating it. He hoped that one day he would reach that carrot. Now it became a good idea for the man but the poor donkey could never get that carrot. Why? Because that carrot is just a smokescreen. Many people are just like that donkey. They go on working hard, hoping that one day they will become rich. But money remains just a dream for them. You can never reach it by running after this dream. So instead of working for money, let the money work for you. When you want to get rich, do not work just to earn money. Because as soon as we step into the path of becoming rich, our fear and greed start dominating us so that we do not remain poor to poor. Due to this fear, we are able to work more hard. Then our greed starts dominating us. We start imagining all the beautiful things that can be achieved with money. Now this fear and greed confuse us in such an affair that never ends. So we work harder now to earn more and then our expenditure also starts increasing accordingly. This is called the rich dead "RAT RACE" rate race. Now the result of this is that we work extravagantly and spend more to earn money. This is a trap. And you have to avoid this trap of greed and fear. Because most of us who want to get rich, fall for this trap. Do not run after the money, but force the money to run after you. If you have a job, do not go to work thinking that you have to take a paycheck every month i. Because that pay-check hardly fills all your bills. It becomes the story of every month. Then, after getting fed up, you start working hard by finding another job. But even then you are working for money only. And this is the reason why you never get rich.Face the truth You are responsible for yourself and not for others. So whatever questions you have, ask yourself because only you have their answer. Are you working just because there is security in your life? A job from which you have no fear of being fired? Or do you work to earn just two cents? And you think that one day you will become rich like this. Is this enough to set you settings? If your answer is yes, then I regret your thinking because the dream of becoming rich is never going to be fulfilled. You will always live in poverty. But if your answer is "No" then your first step will be to first remove the fear from your mind. Because the fear and greed of not making much money compels you to work without thinking. And this step of ours pushes us towards failure. Of course we all have feelings of fear and desire, but do not let them dominate us so much that we start taking direct decisions in reverse. It would be better to think a lot about what we do first. Always work with the mind, not with the heart. Ask yourself every morning are you able to do as much as you should? Are you able to make full use of your potential? Stop thinking like ordinary people who do work only and only for money. Stop thinking that "My boss pays less, I should get more, I can earn more". Remember, you are only responsible for your problems, no one else is. If the boss does not increase your salary, do not accuse him, do not blame the tax. When you take responsibility for your own problems, then only you can solve it. This is the first lesson Amir Dade taught Robert. Part of this lesson was that Amir Dade hired him in a convenience store. They did not get any money for this work. They just kept working. The advantage of this is that he kept working from his heart and during this time many new ideas kept coming in his mind. He got many ideas about how to get the money behind him. He saw that the clerk of that store would tear the front page of the comics book in two. She would keep half and throw away half. A distributor used to come to the store late in the evening. He would take the top half of the comics book for credit and in return give new comics books. One day, he asked the distributor if he could get old comics books. He agreed on the condition that he would not sell those comics. This was a new business idea in his mind. He started renting those old comics books to his friends and other children to study. In return they used to charge 10 cents for every book. Every book was given for reading for only two hours, so in reality they were not selling them. They did not even have to work on the garage from where they used to rent comics. He hired Mike's sister, for which he was paid $ 1 every week. In the same week he earned $ 9.5. In this way he learned that do not let money work for yourself, rather you work for money.

Lesson 2: Why to teach Financial Literacy?

In 1923, there was a meeting at Edgewater Beach Hotel, Chicago. Many leaders and very rich businessmen of the world became part of this meeting. Among them were Charles Schwab, the owner of a very large steel company, and Samuel Insul, the largest utility president at the time, and many other big businessmen. Many of these people died in poverty after 25 years of this meeting, some had committed suicide and many had lost their balance of mind.

The real thing is that people get so involved in earning money that they forget to learn this special thing how to keep the money. It is the real thing to maintain whatever amount of money you want. And if you have learned this skill, then you will easily face any difficult situation. People who win millions in the lottery live happily for a few years but then get back to the same old condition. Most people have questions about how to become rich? Or what to do to get rich? Most people are disappointed with the response of these questions. But its true answer would be that you first learn to become a fanciful literate. Look! If you have to build the Empire State Building, then first you have to dig a deep pit, then a strong foundation will have to be laid for it. But if you want to build a small house, then by putting a 6 inch concrete slab, your work will also be done. But it is a pity that most of us want to build an Empire State Building on a 6 inch slab. And even if they do so, it is clear that the building will be destroyed.

The poor Dade wanted Robert to study a lot, but the rich Dade wanted him to become a Financially literate. Most school systems teach just building houses, not strong foundations. School education and education have their own importance but in real life this is not all.

Understand the difference between liabilities and assets and buy assets.

It seems very easy to hear. But this is the rule that will help make you rich. Often poor and middle class people consider benefits as asset. But Amir knows exactly what assets are and he buys them. Amir Dead believes in what principal means keep it simple, stupid. He taught this simple thing to the author and his friend Mike, due to which he managed to keep such a strong foundation. The simple point of this learning is that you should understand the difference between liabilities and assets and buy assets, but if it is so simple then every person would be rich. Is not it? But here the matter is the opposite. It is so simple that not everyone thinks about it. People think that they know the difference between liabilities and assets but they only know about literacy and not about literary literacy. Some drawings are given in PDAP with the help of Amir Dad explaining the difference between assets and benefits.

The hair flow pattern of assets is like this:

The income statement should be treated as a statement of "profit and loss". It means simple. Income is how much money came to you and expenditure is how much money you spent. The balance sheet describes the balance between assets and capabilities. Many educated accountants do not even know how the balance sheet and income statement are related to each other.

The cash flow in Liability will be something like this:

Now this chart is very simple to see, it can be easily explained to the people. Assets are the things that make money for you. Suppose you buy a house and rent it, then with the same rent you can also repay the loan that you took to buy the house. Now your home is also yours and the rent that you get On the contrary, Liability makes you spend money out of your pocket. For example, by buying a house and living in it, you are not going to get any rent. So now you must have understood that if you want to become rich, then buy assets and if you want to stay poor then the benefits.

Rich people have more money because they believe in this principal. On the other hand, poor people do not understand this principal properly. That is why it is being emphasized that not just literate but become finitely literate. Nothing is done with just numbers, it makes a difference when you write your own story. It has been seen in most families that the hardworking person has more money, but what is the benefit when all the money is spent in the benefits.

Now see, this is a middle class cash flow:

This chart shows how a middle class man spends his money. And if this remains their way, then they live as middle class all their lives. Or does it even go down. Because you can see that all their money is being spent in the liabilities itself. Sometimes a mortgage, sometimes a rent, a car loan, a house loan, a credit card bill, fees and what not. All their earnings are spent in it.

On the other hand, there are poor people who do not have any liability but they do not have any assets. They also earn money, get celery, but all their money goes away in everyday expenses. Suppose a poor man earns a thousand dollars. Out of that, he spends $ 300 in the rent of his small house, $ 200 on his commuting rent, $ 200 in taxes and $ 200 in food and clothes. Now what is left with him? Nothing at all. And sometimes, you have to work by borrowing, which makes it poorer.

In contrast, the rich keep buying assets. Then those assets give them more money. Their earnings like this go from two to four, four to eight.

Most rich people work with their brains. They take the house on loan and rent it. Rent is paid every month without any hard work, due to which they also repay their loan. Suppose if the loan installment is 1 dollar, then they will charge 2 dollars rent for their house. 1 dollar to the bank 1 dollar in your pocket. So it is not done to earn money without hard work. So in reality there is a gap of thinking between rich dad and poor dad. How to spend your money is just a matter of nothing else.

In the 1960s, if children were asked what they would grow up to be, then everyone had the answer that they would bring good grades and become doctors. Then everyone felt that they would be able to earn a lot of money with good grades. However, many of them have grown up to become doctors today. Despite this, many of them will still be seen frantically struggling. Because he always felt that by earning more money, all his troubles will be removed. But today it is not so. Today many children want to become a famous athlete or CEO, or a movie star or rock star. Because they know that they cannot get success in a career by just relying on good studies and good grades. Nowadays, fanciful nightmare has become very common. Often, new married couples think that their celery will now double because both are earning money. Living in a small house, they now dream of a big house. So they start saving money. Because of this, all their focus is only on making their career. If their earnings start increasing, then expenses are also evident accordingly. Now when you make money without having to be legally literate or spend it without thinking, it happens that you start spending more than before. This is such an affair that keeps going.

And then we too have to follow the same path because whatever we are doing will definitely be right. Is it or not ? But no, it is not so. Amir Dad said that the Japanese knew the power of three things. Swords, Precious Gems and Glass. The sword is a symbol of the strength of the arms, the precious jewels represent the power of money and the mirror shows the hidden power within itself. And that is our biggest strength. When you know yourself, in front of the mirror, if you can ask yourself the question whether I am right or should I also be a part of the crowd, then the answer you will get is your real strength. The poor and middle class allow themselves to become slaves of money, so they never become rich.

Robert and Mike, 16 years old, used to attend every meeting with Amir Dad that they would hold with their accountants, managers, investors and employees. Here we see such a rich dad who is not educated, who left school in 13 years, but today he holds meetings, gives orders to educated people working under him, business tips to them Let us explain. A person who did not become part of the crowd, who took the risk and who did not care for the people. Who did not fear what people would think of him? The result of these meetings was that both the writer and his friend could not concentrate in schooling.

Whenever his teacher gave any work, he had to do according to the rules. He realized how schooling does not allow the talent of children to be enhanced. By killing their creativity, they mold them into a mold and make them a mechanical part of this society. And he also denied the teacher's fact that only by bringing good grades can one become successful and rich. One day Robert had an argument with his poor dad. His father believed that his house was the best investment for him.

But he was running in a rate race. Their income and expenses were equal. He did not have even a single moment to complete them. This is what Robert was trying to explain to him that for his father, that house is not a liability. Their money was being spent at home, there was nothing to get in return. His poor dad could not understand this and this was the difference between poor and immortal dad. Well, their debate went on. He told his poor father that the life of most of the people goes to repay the loan. For the house they buy, they pay a loan for 30 years. Then they take another big house and get their loan renewed. Now the price of the house will also increase accordingly or depends on it.

There are some people who took a huge amount to buy a house. More than the price of the house, the loan went up on his head. Its biggest disadvantage is that people are unable to invest elsewhere because all their money is spent on that house. They never get an opportunity to invest nor do they learn anything about it. And in this way many assets get out of their hands. If people instead focus only on assets, then their future can be much better.

Now for example, Robert's wife's parents shifted to a larger house. He thought that it was a right decision to get a big and new house for himself. Because like others, taking them home was an asset. But they were surprised to learn that the property tax of that house was $ 1000. This was a big price for him. And because he had retired, it was beyond his retirement budget to pay so much money as tax. Of course we are not saying that you do not get a new house. Rather, we want to explain that the more money you take from a big house, the more money you invest in an asset, the better. Your asset will earn for you and after some time you will have so much money that you will be able to easily take the desired house without any loan.

There is a reason behind why the middle class do not grow ahead, and why they continue to get richer and more wealthy. The reason is simple, the rich buy the asset which keeps doubling their money. All their expenses are spent with that money. And what do middle class do? They just wait for a date of the month when their celery arrives. All the celery ends up meeting expenses, so where will the investment be from. And then when the celery grows up, the tax on it also increases and accordingly the other expenses are also incurred. Then in the end the same rate race continues.

A debt-ridden society, where we live:

Understanding your home as the asset is the reason that keeps us under the burden of debt. Today, this is the thinking of most people. If Celery is big, then people think that now they can take a big house because they find it right to use their money. Instead, if the same money is put in the right place, then their life can change forever. But this does not happen because all their time is spent working hard. Considering their job as a safe zone, they cannot think of anything different from that. And at the same time there is so much debt burden on them that they cannot take the risk of leaving the job. Now ask yourself this question, if you leave your job today and sit down, then how many days will you live? Because if you are not financially literate, if you have spent all your life solely on celery, and you have taken the benefits instead of essays, then your life is definitely a tough challenge. Your work cannot depend only on net worth. Net worth shows how much money you actually have, even if it is in the form of an old car lying in a garage. Now even if that car is of no use. Whereas wealth means how much more money you are making from the money you have. For example, if you have an asset that makes me $ 3000 every month, and you spend $ 6000 every month, then I will be able to spend only half a month. So the solution would be to give a big sum of money from your essays. When you start getting that $ 6000, then you will not become rich overnight, but in this way you will start getting wealthier. Now even if you suddenly leave the job, your assets will cover all the expenses. You will be able to become wealth only when your expenses are less than the growth of your assets.

Third Lesson 3: Keep Your Own Business

Ray Kroc, the founder of the world's largest food chain, Mac Donald, gave a speech in an MBA class. It is a matter of 1947. His speech was very brilliant, inspiring the people. After the speech, when the MBA class students requested to spend some time with him, he went to drink beer with them. In conversation, Ray suddenly asked a question, "Do you know which business I am in?" Now everyone knew that they used to sell hamburgers. He started laughing at this and said that his real business is real estate. Because for Mac Donald every location is chosen thoughtfully. Where its franchise is made, the land is also sold along with it. So it simply means that the buyer of Mc Donald's franchise had to buy that land as well. So this is how it became a real estate business as well. This is the lesson Amir Dad taught Robert that often people work for everyone except themselves. They work for the government after paying taxes, working for the company where they work, paying for the bank mortgages. And all this because our education system is like this. The school teaches us to be employees and not employers. You become what you study. If you read science, doctor. If you read mathematics, then you become an engineer, meaning what you read. Now the problem is that it does not help the students, because they get entangled in the difference between a job and a business. When someone asks what is your business, you should not say that, I am a doctor or a banker, because that is your profession, not business. To say that what you do is make your business, not a job. Do not waste your whole life working for others and make them rich, but work to make your life happy. Many people realize that their house loan is taking their life too late. And then they think that what they were making the mistake of believing was not actually an asset. As he took the car, all the expenses associated with it became his benefits. A job is necessary to complete them and if that safe job ever gets out of their hands then their troubles start. That is why we are putting so much emphasis on the asset column and not on your income column. And this is the only way to get financially secure. Net worth is not the right way to know how rich you are because whenever you sell your assets, they are also taxed. You do not get as much money as you think. According to your balance sheet, you will have to pay tax on whatever amount you get. Do not give up what you are doing. This book will never give you this advice. Keep doing your job, but also submit assets. And by assets, I mean assets really and realistically. I will not say that you take a car because they are not asset in my eyes because as soon as you start driving it it loses 25% of its price. Cut expenses as much as possible and reduce the benefits. What types of assets should be purchased now?

Here we give you some examples:

• Business where your presence is not necessary, which other people run for you. Because if you give more time there, it will be a job and not a business. Invest in real estate • buy stocks and bonds When you buy an asset, invest money on things of your choice. Because only you will be able to pay attention to it. If you are interested in him, then you will understand him better. Robert was interested in real estate and stakes, especially investing in small companies. She never quit her job on the advice of her rich dad. He kept on doing the job as well as making his Asset column bigger and stronger. Don't let a penny you earn go waste. Take your money as your slave and work for you. Do you want to buy luxury? Buy from a hobby, no big deal. But do not forget that this is the difference of thinking between rich and middle class. Where the middle class will spend the money in luxury first, the rich man will buy it in the end. Having understood this much, now in the next chapter, you will know about the biggest secret of rich people.

Lesson 4: Wealthy Invents Money:

Alexander Graham Bell patented it after doing a telephone inventory. When his business became large and difficult to maintain, he went to Western Union and offered to sell his patent and a small company for $ 100,000. The then Western Union president turned down the offer. They felt that this price was a bit high. And then a big company AT&T AT&T was born. Robert has been teaching professionally since 1984. One thing that he learned after teaching thousands of people was that they all had potential. Rather, every human has potential that can make us great. Yet what stops us is to keep a check on ourselves.

After leaving school we come to know that grades are not enough to get ahead in life. Just like smart people do not move forward but they grow who are also bold. It is true that in order to be a fanciful genius, it should also have knowledge but at the same time it needs courage and boldness. Most people do not want to take any risk in terms of money, but to get rich, you have to take risk. Because in the coming years a new Bill Gates may be born or the next Alexander Graham Bell and the rest may become poor by becoming bankrupt. Now this is your choice, what do you want to be among them?

If you increase your financial IQ, you can achieve a lot. And if not, then the coming years can be even more scary because every old one goes and new one comes. So what is today is the happiest time. In today's era, people are doing more financially straggles because their thinking is still old. Then they will not accept their mistake and either blame their boss or new technology. What was once an asset in yesterday, has become a liability today. So you need to be updated. Robert has designed a game he calls "Cash Flow". It teaches people how money works. What is the way to get rich and how to get out of the rate race? All these things were tried to explain this game.

One day a woman came. While playing the game he won a boat card which meant that he won a boat in that game. The woman was very happy, but when she came to know that she had to pay a huge amount of tax to get the boat, her happiness disappeared. The boat no longer became an asset for him, but a liability. He now came to know that this boat will take his life. He did not understand this idea and demanded refund. She got her money back and she left. But later he called and told that he now understood the idea of the game. She was able to connect her life with that game.

His anger was justified because he could not understand how money works. We also do this often. We are angry at what is beyond our comprehension and we start blaming it for every problem in our life. But if you think with a cool mind, then this method will be completely wrong. It would be better if we try to understand them, then we can win the game of life.

Many people win a lot of money in cash flow games. Then they do not understand what to do with that money, then they start losing. The reason for this is their old thinking which does not allow them to proceed. And then they lose all the money later. Some people say they lost because they did not have the right cards. Many people like this, sitting in search of the right opportunities in life. Even if some people get the right opportunity, they will not be able to take advantage of it because they will say that they had no money.

Now there are some who get both money and opportunity, yet they could not achieve anything because in reality they could not understand that it is an opportunity. Financial intelligence means how creative you can be with money, if you get a chance, what will you do without money, and if you have money but if you don't have the opportunity, then it will depend on your financial intelligence. Does. Most people know the same solution to earn a lot of money by working hard.

But you have to learn how to create an opportunity for yourself and not sit in wait for it. The most important thing about the rich people is that they know that money is not the real thing, it is the real thing to know its true meaning. Knowing that we can make what we want from it. Our brain is the biggest asset for us. This can make us super rich or super poor depends on how we use it. If you want to follow the steps of those who are successful, then you will have to learn how to create a desire to increase your money.

You need to invest your biggest asset i.e. your brain. You have to be finitely intelligent. Let us understand an example of this. In the 1990s, the economic conditions of Arizona and Phoenix were going bad. The people there were being advised to save $ 100 every month. The idea of saving money for bad times is also true to some extent. But what is the use of the money that you keep accumulating? It is better to invest some part of it which will benefit you later. Well, let's talk about the people of Arizona and Phoenix who were facing financial crisis. In such a situation, the investor found this a great opportunity. People who were selling their property at their own cost, many investors bought hands.

Robert also bought a house valued at $ 75,000 for just $ 20,000. He then gave an ed in the attorney's office. Customers broke down to take a $ 75,000 home for just $ 60,000. Robert's phone didn't stop ringing. This money was going to meet the asset he had taken from the customer in the form of promissory note. And it took them only 5 hours to earn this money. The 40,000 rupees he invented were created in his column of assets. And without tax, he suddenly took advantage of an opportunity and created this money by adding it to his income column.

A few years later, his business created so much money that his company's cars, gases, insurance, dinner with clients, trips and everything else were covered. By the time the government imposed taxes on those expenses, most of these things had been spent in pre-tax expenditure. A few years later, the house that was sold for $ 60,000 was now worth $ 110,000, but they still had some opportunities, but they were so few that they had to apply a valuable asset to Robert and his time. So they moved forward.

They now had to find new opportunities. Now you have a question to yourself. Working hard is also very hard work. Enter 50% tax and save the rest. Now, those savings will give you 5% interest and then pay more tax on that too? It would be better to invest your money and time on your most powerful asset i.e. your mind and become a financially intelligent.

This world is never the same. What is today will not happen tomorrow. Sometimes there will be a slowdown and sometimes there will be a boom phase. Technology will get better with time. Today the market is up, tomorrow it will be down, especially the stock market changes everyday, but what difference will it make to you if you are financially intelligent? Because you will be ready for every situation. You will get a lot of opportunities in life where you can take advantage of your financial intelligence, just need to grab those opportunities.

Usually, we can see the investor in two ways. First those who buy package investment. And it is very easy and hassle free. Other investors create their own investments for themselves. You can also call them professional. They make many times more money than they invest. Now if you want to become such an investor, then you especially need to understand these three skills:

1. Find an opportunity that you cannot find the rest:

Remember, your mind can see those who do not even see the eyes of the rest.

2. Raise Money:

When the money is needed, the middle class only goes to the bank, but investors of another type raise the money and raise capital. They do not always need a bank.

3. Organize the smart logo:

Intelligent people are those who work with smart people more than themselves, so choose your investment advisor before investing. I know that all this is more for you but the rewards are excellent. There is a lot of risk in life, but only by learning to handle them, you will become rich.

Lesson 5: Work for learning, not for money

Robert was interviewed once by a journalist. Robert had already read his articles before and was very impressed with the style of writing by that journalist. When the interview was completed, the journalist told Robert that she wanted to be famous one day by becoming a famous writer. Robert asked her "So what is stopping him from becoming famous?" The generalist said that "his job could not progress further". At this, Robert suggested that the generalist should join a sales class. Journalist told that a friend of his has already given him this offer, but he finds it a small task. She had forgotten that Robert himself had ever gone to the sales school.

The point of this is that if you have a talent on which you want to earn some money, then your talent will not be enough because how to redeem that talent till you know this, your talent is just useless. Until you learn the skill of presenting it in front of people, you cannot earn anything. So there is no shame in learning the art of selling. No salesmen should be ashamed of it.

One of the biggest differences between rich dad and poor dad was that poor dad always used to worry about the job so that the job was always secure. Because a safe job was everything for them. Whereas the rich dad always insisted on learning something only and only. You have to learn a lot to become rich. Looking at its different aspects, schools reward us for mastering only one particular thing. See an example of this.

When doctors take a master's degree, after that do a doctorate in one of the special fields such as pediatric or something. Meaning they have to study a lot on a small topic to master that field. And this is their reward. To learn a lot, the knowledge that you learn a little will only come when you work for different companies, know different things of the world, how things work, all these things will be experienced only then your knowledge Will grow. Perhaps this was the reason Amir Dad used to take little Robert and Mike with him when he went to see his doctors, accountants, lawyers or any professional.

When Robert left his high paying job to join the Marin Corps, his poor but educated father could not understand why Robert left such a great job. He was, in a way, deeply disappointed by this decision. Robert tried his best to explain why it was important for him to do so, but he was not digesting it. Robert tells them that they want to learn how to fly in the open sky. He wanted to know how to handle a team of workers, how difficult it is to run any company on his own, Robert wanted to learn all this.

After returning from Vietnam, Robert resigned from his job and joined the Xerox Corps. He did not want this job for any benefit. He was so shy that he would have been sweating with the thought of selling anything to anyone. To overcome this shortage, he studied the sales training program of Xerox. Robert then started his own company and sent his first shipment. If they had failed in this, they would have gone bankrupt.

But he took this risk and remembered the learning of his rich dad that of course you can take the risk of going bankrupt before the age of 30 because at this age you also get a chance to recover. Most employees pay their workers so much that they do not quit work, and most workers also work hard because they do not get fired. That is why they are only meant by the benefits they get from their celery and company. Some years go well with this thinking, but it does not work for a long time. So why don't you learn everything you want to learn before you choose a particular profession for yourself, because once you have chosen your profession, you will be bound by it forever.

End This By Adnan Saul Rajput ( Time 1.10)

Great❤

ReplyDelete